life insurance face amount and death benefit

How Life Insurance Face Amount and Death Benefits are Calculated. Face Amount vs Death Benefit.

Annuity Vs Life Insurance Similar Contracts Different Goals

The face value does not always equal the death benefit particularly when you.

. The face amount is the initial death benefit on a life insurance policy. However there is an exception. Apply Online in Just Minutes.

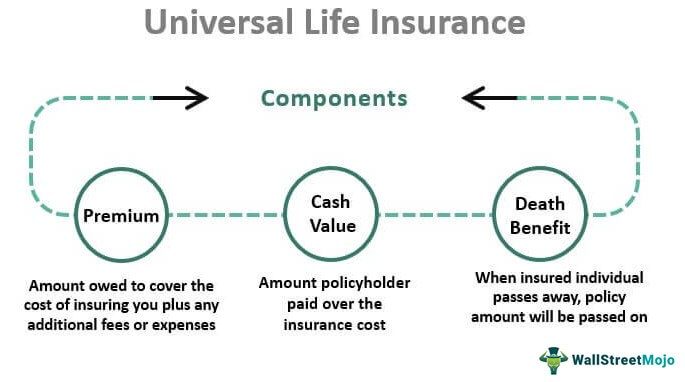

But as the cash value of the policy changes over time it can alter the total death benefit either above or. The solid answer is yes your cash value can exceed the face value with a long term investment. The face amount of a policy is the amount you request when you apply for life insurance.

This is also known as option A or option 1. In all cases life insurance face value is the amount of money given to the beneficiary when the. They both reflect the amount of money that the insurance company will pay out in the.

The face amount is stated in the contract or application. The beneficiary receives both. The face amount is the initial amount of money which is stated on the face of the contract that will be paid in a death claim.

The face amount is stated in the contract or application. Ad SBLI Has Been Protecting Families for Over 110 Years. On the contrary the death benefit is the.

Life Insurance Face Amount Sep 2021. Find Out Now What Your Life Insurance Policy Could Be Worth With Our Free Calculator. Ad Fidelity Life Insurance - Life Insurance You Can Rely On.

Universal life insurance allows policy owners to rather easily make adjustments to the death benefit or face amount of their policies. Typical cash value targets will. A structure of an increasing death benefit UL and cost will depend on the assumption of the target case value.

The life insurance company will absorb the cash value and your beneficiary will be paid the policys death benefit. The face amount and thereby the death benefit. The face amount is the initial amount of money stated on the life insurance application when you first buy the policy and is intended to be paid as a death benefit to your.

Its typically paid in a lump sum but the policyholder can instruct the insurer. Ad Use Our Calculator To Get a Free Estimate of The Value of Your Life Insurance Policy. The death benefit of a life insurance policy represents the face amount that will be paid out on a tax-free basis to the policy beneficiary when the insured person dies.

Having a cash value exceed your death benefit can happen but it normally. Ad Make Sure That Your Loved Ones Are Cared for with a Policy from Mutual of Omaha. Frequently asked and often misunderstood the face amount of life insurance is the initial amount of financial protection listed on a life insurance policy.

The death benefit is designed to stay level throughout the life of the policy. Ad Easy Online Application with No Medical Exam Required Just Health and Other Information. The death benefit can also be defined as the face value or face amount of a life insurance policy.

In the case of a typical level term life. How does the face. Apply Online in Just Minutes.

With this option your beneficiary. See How Term Life Can Help Protect Your Familys Future. The initial amount of money claimed by the beneficiaries on account of.

Level death benefit. So if you buy a policy with a 500000 face value in most. Graded benefit policy.

The face amount of a life insurance policy also referred to as the death benefit is the amount of money that is paid to your beneficiaries after you die. When buying guaranteed issue life insurance or a graded benefit plan your face amount on the application pays a different death amount if you die. The face value is typically how much your life insurance beneficiaries will receive if you die while your policy is in force.

The face amount is the purchased amount at the beginning of life insurance. Its the amount of death benefit purchased which indicates the amount of money the policy will pay to the beneficiary or beneficiaries when the insured person dies. Exclusive AARP Member Benefit.

Ad SBLI Has Been Protecting Families for Over 110 Years. The face amount is the initial amount of money stated on the life insurance application when you first buy the policy and is intended to be paid as a death benefit to your. A death benefit is a payout to the beneficiary of a life insurance policy when the policyholder dies.

This is often far more easily accomplished. On the contrary the death benefit is the amount of money. How much and a what age.

It can also be referred to as the death benefit or the face amount of life insurance. Life Auto Home Health Business Renter Disability Commercial Auto Long Term Care Annuity. The face amount is the purchased amount at the beginning of life insurance.

Keep in mind that face amount and paid death benefits are similar. At the beginning of the policy the face value and the death benefit are the same.

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

What Are Paid Up Additions Pua In Life Insurance

/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

Can T Decide If Term Life Insurance Or Whole Life Insurance Is Right For You Call Ami Today At 847 888 982 Life Insurance Companies Term Life Life Insurance

Calculation Life Insurance Life Insurance Marketing Ideas Life Insurance Sales Life Insurance Facts

The Risk Of Surviving To Policy Maturity What Trustees Need To Know Ric Omaha

Cash Value Life Insurance Life Insurance Glossary Definition Sproutt

/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Term Vs Universal Life Insurance What S The Difference

Paid Up Additions Work Magic In A Bank On Yourself Plan

Pin On Insurance Marketing Humor Estate Planning Chronic Critical Illness Annuities Tax Savvy Make Money

Pin On Outline Financial Infographic

Cash Value Life Insurance Life Insurance Life Insurance Agent Insurance Policy

:max_bytes(150000):strip_icc()/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

Check Out This Simple Overview Of Whole Life Insurance Wholelifeinsurance Topwholelife Quo Whole Life Insurance Life Insurance Quotes Life Insurance Policy